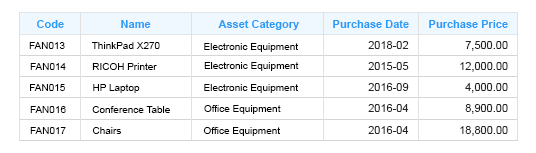

Easily maintain on all of your business’ assets including – property, vehicles, equipment, machinery, hardware and more. Add individual assets to your register or quickly import all of your assets using the xml import feature.

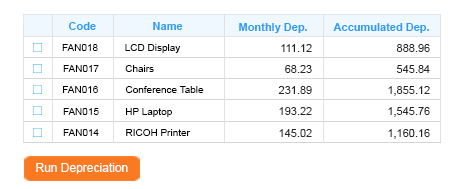

Calculate depreciation

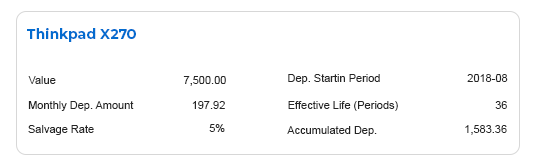

Set up asset categories applicable to your business and asset types. Specify the purchase date, purchase price, effective period, salvage value to easily calculate the depreciation and current value of your fixed assets. Set up depreciation schedules with your accountant to smooth out you P&L.

Calculate depreciation

Set up asset categories applicable to your business and asset types. Specify the purchase date, purchase price, effective period, salvage value to easily calculate the depreciation and current value of your fixed assets. Set up depreciation schedules with your accountant to smooth out you P&L.

Get a complete picture of your fixed assets

Quickly view depreciation summaries to know your deduction for a given month and over the year. Get a complete picture of all your business’ assets, their status, remaining value and remaining effective period.